Tax Forms For New Employees Ontario . set up and manage employee payroll information. Get the employee's social insurance number, determine the province. the td1on form is a document that employers use to make sure they are withholding enough of your pay. (with benefits and tips) cra and tax forms. You need to fill out some forms required by the canada revenue. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. As an employee, you complete this form if you have a new employer or payer and will. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay.

from www.dochub.com

As an employee, you complete this form if you have a new employer or payer and will. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. set up and manage employee payroll information. You need to fill out some forms required by the canada revenue. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. the td1on form is a document that employers use to make sure they are withholding enough of your pay. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay. (with benefits and tips) cra and tax forms. Get the employee's social insurance number, determine the province.

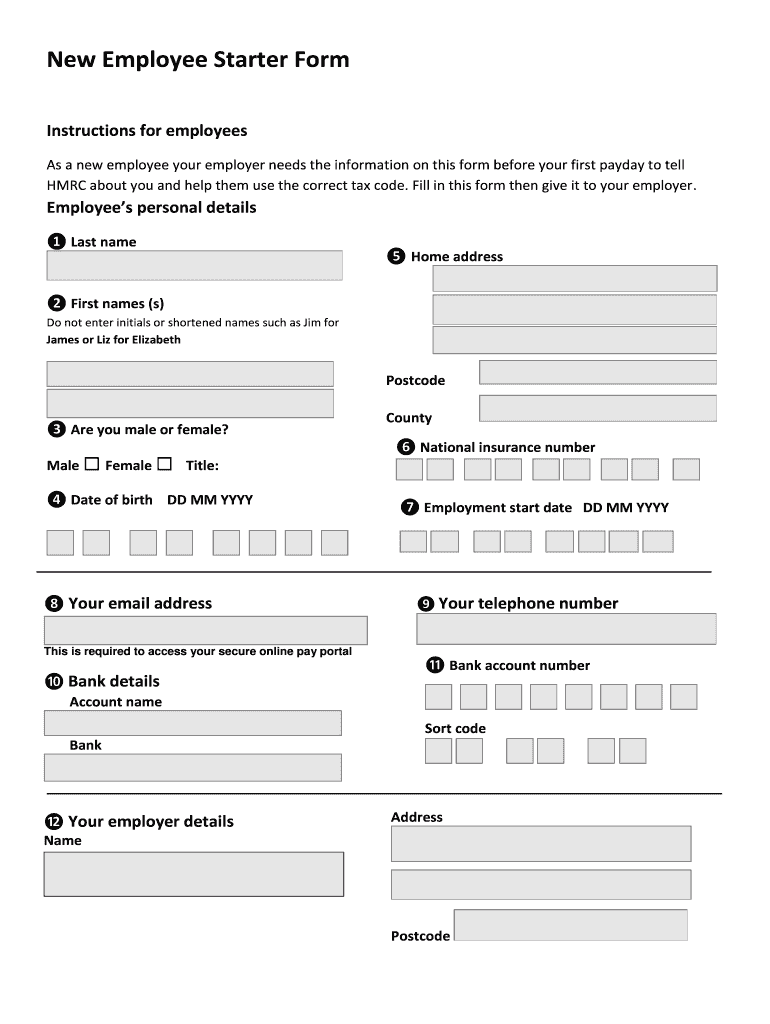

New employee starter form Fill out & sign online DocHub

Tax Forms For New Employees Ontario As an employee, you complete this form if you have a new employer or payer and will. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. As an employee, you complete this form if you have a new employer or payer and will. Get the employee's social insurance number, determine the province. You need to fill out some forms required by the canada revenue. (with benefits and tips) cra and tax forms. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay. the td1on form is a document that employers use to make sure they are withholding enough of your pay. set up and manage employee payroll information.

From barbiqwrennie.pages.dev

W4 Form 2024 Example Filled Out Online Cilka Delilah Tax Forms For New Employees Ontario You need to fill out some forms required by the canada revenue. As an employee, you complete this form if you have a new employer or payer and will. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. (with benefits and tips) cra and tax. Tax Forms For New Employees Ontario.

From exoquexeg.blob.core.windows.net

Employee New Hire Tax Forms at Suzanne Bartz blog Tax Forms For New Employees Ontario the td1on form is a document that employers use to make sure they are withholding enough of your pay. (with benefits and tips) cra and tax forms. Get the employee's social insurance number, determine the province. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your. Tax Forms For New Employees Ontario.

From www.dochub.com

Tax declaration form Fill out & sign online DocHub Tax Forms For New Employees Ontario set up and manage employee payroll information. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay. As an employee, you complete this form if you have a new employer or payer and will. You need to fill out some forms required by the canada revenue.. Tax Forms For New Employees Ontario.

From create-fillable-form.com

Create Fillable Tax Declaration Form And Keep Things Organized Tax Forms For New Employees Ontario As an employee, you complete this form if you have a new employer or payer and will. the td1on form is a document that employers use to make sure they are withholding enough of your pay. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay.. Tax Forms For New Employees Ontario.

From www.sampleforms.com

FREE 18+ Employee Information Form Samples, PDF, Word, Google Docs Tax Forms For New Employees Ontario the td1on form is a document that employers use to make sure they are withholding enough of your pay. You need to fill out some forms required by the canada revenue. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. Get the employee's social insurance number,. Tax Forms For New Employees Ontario.

From printable.nifty.ai

Free Printable New Employee Forms PRINTABLE TEMPLATES Tax Forms For New Employees Ontario You need to fill out some forms required by the canada revenue. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. the td1on form is a document that employers use to make sure they are withholding enough of your pay. As an employee, you complete this. Tax Forms For New Employees Ontario.

From www.canada.ca

Starting to work Learn about your taxes Canada.ca Tax Forms For New Employees Ontario As an employee, you complete this form if you have a new employer or payer and will. (with benefits and tips) cra and tax forms. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. Get the employee's social insurance number, determine the province. set up. Tax Forms For New Employees Ontario.

From mavink.com

New Employee Tax Forms Printable Tax Forms For New Employees Ontario You need to fill out some forms required by the canada revenue. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay. (with benefits and tips) cra and tax forms. the td1 form, also known as a personal tax credits return form, helps new employers. Tax Forms For New Employees Ontario.

From cindaynathalie.pages.dev

Tax Form 2024 Ontario Online Lucie Kimberlyn Tax Forms For New Employees Ontario You need to fill out some forms required by the canada revenue. set up and manage employee payroll information. the td1on form is a document that employers use to make sure they are withholding enough of your pay. td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take. Tax Forms For New Employees Ontario.

From helliyantoinette.pages.dev

Tax Form 2024 Canada Tax Cayla Shelagh Tax Forms For New Employees Ontario Get the employee's social insurance number, determine the province. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. As an employee, you complete this form if you have a new employer or payer and will. set up and manage employee payroll information. the td1on form. Tax Forms For New Employees Ontario.

From formspal.com

Hr117 1 New Employee Information PDF Form FormsPal Tax Forms For New Employees Ontario (with benefits and tips) cra and tax forms. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. As an employee, you complete this form if you have a new employer or payer and will. You need to fill out some forms required by the canada revenue.. Tax Forms For New Employees Ontario.

From mavink.com

New Employee Forms Printable Tax Forms For New Employees Ontario set up and manage employee payroll information. (with benefits and tips) cra and tax forms. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. Get the employee's social insurance number, determine the province. td1s are required so your employer and the canada revenue agency. Tax Forms For New Employees Ontario.

From www.uslegalforms.com

Ontario Form 1000 2000 Fill and Sign Printable Template Online US Tax Forms For New Employees Ontario Get the employee's social insurance number, determine the province. set up and manage employee payroll information. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make. Tax Forms For New Employees Ontario.

From www.templateroller.com

IRS Form W4 2020 Fill Out, Sign Online and Download Fillable PDF Tax Forms For New Employees Ontario you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. (with benefits and tips) cra and tax forms. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. As an employee, you complete this. Tax Forms For New Employees Ontario.

From www.exemptform.com

Tax Exemption Form Ontario Tax Forms For New Employees Ontario td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay. the td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate. you will need to open an account with the canada revenue agency (cra) for. Tax Forms For New Employees Ontario.

From www.formsbank.com

Fillable Tax Return Form City Of Ontario, Tax Tax Forms For New Employees Ontario set up and manage employee payroll information. the td1on form is a document that employers use to make sure they are withholding enough of your pay. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. As an employee, you complete this form if you. Tax Forms For New Employees Ontario.

From incometaxformsgorokura.blogspot.com

Tax Forms Ontario Tax Forms Tax Forms For New Employees Ontario td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay. (with benefits and tips) cra and tax forms. Get the employee's social insurance number, determine the province. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you. Tax Forms For New Employees Ontario.

From www.dochub.com

2021 tax forms ontario Fill out & sign online DocHub Tax Forms For New Employees Ontario You need to fill out some forms required by the canada revenue. the td1on form is a document that employers use to make sure they are withholding enough of your pay. you will need to open an account with the canada revenue agency (cra) for the payroll deductions you must make from your. As an employee, you complete. Tax Forms For New Employees Ontario.